Stocks maintained their winning streak for much of the week, sending the major indexes to a new round of records, despite the devastating shooting in Las Vegas last Sunday evening, which claimed the lives of more than 50 people and injured over 500 others. The large-cap S&P 500 Index notched its eighth consecutive daily gain before falling back a bit on Friday – its longest winning streak since 2013. The S&P also set its sixth consecutive record closing level on Thursday before some profit-taking on Friday ended the streak. It was the index’s longest streak of records since 1997.

As has often been the case in recent months, last week’s rally coincided with exceptionally low volatility. On Thursday, the CBOE Volatility Index (the “VIX”) closed at the lowest level on record since its inception in 1993. At the start of the fourth quarter on Monday, the Morningstar Fair Value ratio for all rated stocks was 1.03, suggesting that the market is slightly overvalued overall.

Last week’s bullish bias had its roots in last week’s run to record highs, which was sparked by the release of the GOP’s latest tax reform outline. The House kept the ball rolling this week by passing a budget that slashes government spending in anticipation of decreased tax revenue. The GOP still has a long way to go, given its difficulty getting things done this year, but traders liked the apparent progress.

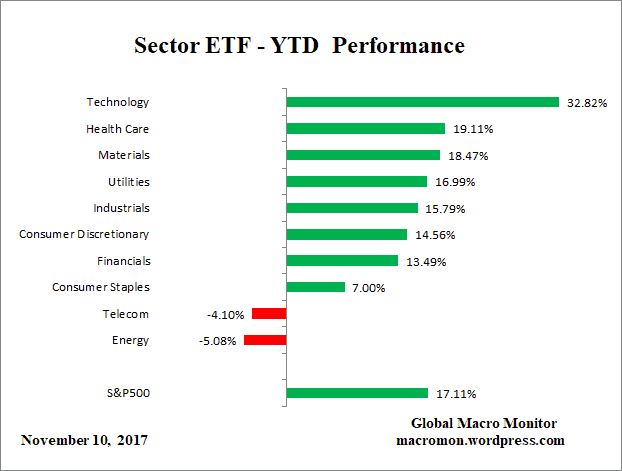

Excited by the idea of a tax overhaul, the S&P 500’s financial sector climbed 1.9 percent last week to finish comfortably ahead of the broader market. The financial sector has added 10.6 percent since closing at a three-month low on September 7 and now trades just a tick behind the benchmark index for the year.

Automakers were also strong last week after reporting largely solid U.S. sales figures for the month of September, which were helped by the replacement of vehicles lost to Hurricane Harvey and Hurricane Irma. GM showed particular strength, climbing 11.3 percent, after reporting a year-over-year increase of 12.0 percent. Netflix also did well, up 9.2 percent and hitting a fresh all-time high, after UBS raised its target price to $225 from $190 and following news that the company will raise the price of its standard and premium video-streaming services.

Equities did end the week on a down note, however, following a noisy employment report for September issued on Friday. The U.S. economy lost 33,000 jobs in September – the first monthly decline in jobs for seven years – in the aftermath of the damage done by Hurricanes Harvey and Irma. Consensus expectations called for a gain of 90,000 jobs, after accounting for the hurricanes, well below the monthly average of 175,000 so far this year. Harvey shut down activity in Houston for days, while Irma hit businesses in Florida. As those businesses re-open, jobs should return. Meanwhile, the jobless rate dropped to 4.2 percent, its lowest level since 2001.

As a reminder, average hourly earnings growth, which is positively correlated with inflation, has been tepid in recent months, putting the Fed’s rate-hike forecast into question. However, following Friday’s jobs report, the market now strongly seems to believe the U.S. central bank will hike rates one more time this year, thereby achieving its goal of three rate hikes in 2017. The fed funds futures market now places the chances of a December rate hike at 93.1 percent, up from last week’s 77.9 percent.

U.S. Treasury yields increased following the jobs report, an indication that traders were focusing on the strong wage gains in the report rather than the payrolls decline. The yield increase followed a modest rise earlier in the week, fed by the strong economic data and recent comments from Philadelphia Federal Reserve President Patrick Harker, who noted that he had “penciled in” a December rate hike despite low inflation readings. Rising yields helped the U.S. dollar climb to its highest level since July.

Rising tensions between the Spanish government and secessionists in Spain’s Catalonia region cast a shadow over European markets during the week. Spain’s main index, the IBEX 35, tumbled in what was one of its worst weeks in two months, with bank shares recording steep losses following concerns among investors about key lenders headquartered in Catalonia. However, while the future of the independence movement remains uncertain, Catalonia is not likely to become independent anytime soon. Still, a lengthy dispute on that score would, of course, weaken economic growth in Spain.

The British pound had a very rough run last week, shedding more than 2 percent against the dollar. The currency has declined 13 percent since the Brexit vote. Prime Minister Theresa May turned in what many saw as a lackluster performance at an annual meeting of her Conservative Party early last week, raising questions about her leadership. The pressure on May increased on Friday when a political rebellion aimed at removing her from power burst into the open. May has pledged not to step down, but her position seem less stable by the day.

With several major Asian markets closed for holidays last week, Japanese stocks posted good gains in quiet trading. Chinese stocks had a great week as manufacturing activity there surged in September, suggesting that Beijing’s efforts to clean up the country’s indebted financial system and crack down on polluting industries haven’t yet curbed economic growth.

rpseawright.com

[ctct form=”269″]