Round-Up the Usual Suspects

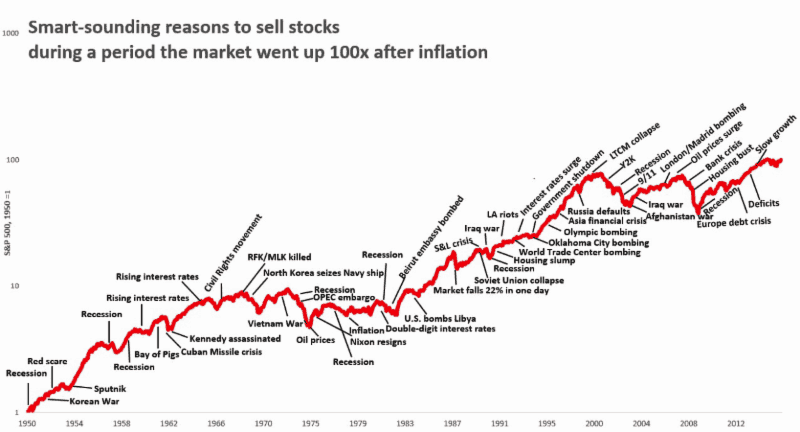

Given this week’s market turmoil, it seems to be a good time to bring back the above chart before getting to what happened this week and why.

And now the news…

Major Strasser has been shot. Round up the usual suspects.

-Captain Louis Renault (Claude Reins), in Casablanca

After the previous week’s big bounceback, last week saw the markets return to volatility and downward pressure. Domestic stocks dropped sharply last week, erasing 2018 gains as the usual suspects, including trade tensions, fears of slowing U.S. and Chinese economies, Fed worries, and international geopolitics returned to prominence after the previous week’s reprieve. The tech-heavy Nasdaq and the smaller-cap benchmarks fared worst. Markets were again highly volatile, although the VIX remained below the multi-month highs it had established in October. Tumbling longer-term U.S. Treasury bond yields heavily influenced equity markets — weighing on sentiment generally and punishing financial shares by lowering lending margins for banks, but benefiting utilities stocks, whose dividends became more attractive in comparison.

The Nasdaq fell 3.05 percent, the Dow dropped 2.24 percent, and the S&P 500 was down 2.33 percent, their worst start to a December since 2008. Stocks had earlier climbed on the back of renewed expectations for the Federal Reserve to pursue a slower interest-rate path. The benchmark 10-year U.S. Treasury note closed last week yielding 2.85 percent. The Fed is still widely expected to hike the fed funds rate by a quarter percentage point next week, but the path for next year is now seen as much less certain. U.S. financial markets were closed on Wednesday in observance of a national day of mourning due to the passing of former President George H.W. Bush.

The U.S. trade conflict with China again seemed to dominate sentiment. Stocks jumped in early trading Monday, following the weekend announcement from the White House that China had agreed to increase agricultural imports from the U.S. and eliminate tariffs on U.S. auto imports. In return, officials said that the U.S. had agreed to postpone for 90 days a planned increase from 10 to 25 percent in the China tariff rate.

However, trade optimism evaporated on Tuesday, sending stocks sharply lower by the close. Traders appeared to respond to a series of tweets from the president, in which he questioned whether a “real deal” was possible with China and referred to himself as a “Tariff Man.” Traders also seemed worried because the Chinese failed to acknowledge many of the details in the purported agreement and the administration itself offered conflicting statements over when the clock would start on the 90-day postponement. Finally, the appointment of U.S. Trade Representative Robert Lighthizer, viewed by many as a trade hawk, to oversee trade negotiations was seen as bad news.

After a short respite due to a report from The Wall Street Journal that the Fed could slow to expected pace of its tightening measures (and the futures market now suggests one tightening in 2019 rather than the two that was previously deemed likely), the dispute with China took a new and concerning turn on Thursday, sending stocks sharply lower again. Reports surfaced that Canadian officials had acted at the request of the U.S. over the previous weekend and arrested a high-profile executive of Chinese telecom giant Huawei on suspicion of violating Iranian sanctions. White House officials later stated that President Trump had been unaware of the extradition request while he was meeting with President Xi Jinping of China, but the arrest sparked widespread condemnation in China. U.S. officials have viewed Huawei’s technology as a security threat and have pressed allies not to do business with the firm.

The slump turned into a stampede Friday, as November payroll gains missed expectations and appeared to spark another round of selling to end the week. The jobs figures are evidence of a slow cyclical decline in the labor market, but moderating gains will sustain downward pressure on the unemployment rate through next year, according to most analysts. Indeed, some other recent economic data surprised on the upside. Gauges of both manufacturing and service activity increased from already elevated levels, and the preliminary release of the University of Michigan’s index of consumer sentiment in December came in a bit above consensus forecasts.

Another factor in the market’s declines appeared to be a partial inversion of the yield curve. For the first time in over a decade, yields on 5-year Treasury notes briefly fell below 3-year U.S. Treasury note yields. Although a yield curve inversion is concerning as a harbinger of recession, the 3T/5T spread is generally not seen as noteworthy. Moreover, inversions can come years before the onset of a recession, and quantitative easing by central banks to put downward pressure on long-term rates may be distorting signals being sent by the bond market. The more closely watched (and significant) 2- to 10-year portion of the yield curve did not invert last week but did trade at its tightest level since 2007.

European stocks fell throughout last week, as hopes soured for reduced trade tensions between the U.S. and China. The pan-European STOXX Europe 600 and the FTSE 100 fell more than 3 percent on Thursday alone, their worst one-day declines since the June 2016 Brexit vote. The auto industry there was hit particularly hard, as the U.S. affirmed that it does not have a deal in place for China to eliminate tariffs on American-made cars. Germany’s DAX, the broadest measure of shares in Europe’s largest economy, fell more than 4 percent for the week, slipping into bear market territory, and in line with steep declines in global stocks. The index, which has lost 20 percent since its January 23 peak — its worst performance since 2008 — is very sensitive to global economic concerns given the many automotive-heavy and export-driven member companies. Automakers and industrial stocks led the declines on concern that a re-escalation of U.S.-China trade tensions could put barriers on exports to Germany’s two biggest markets.

Stocks in China closed last week higher, but news of the Chinese telecom executive’s arrest late in the week turned sentiment around. The Shanghai Composite and large-cap CSI 300 began the week stronger after Presidents Trump Xi agreed on a 90-day tariff truce. As in the U.S., the temporary truce lifted hopes that the U.S. and China would resolve the trade rift that has increasingly been taking a toll on profitability for U.S. and Chinese companies. The arrest, pending extradition to the U.S., brought outrage in China and threatened to sink Sino-U.S. relations to a new low. Both the Shanghai Composite and the CSI 300 pared their weekly gains to less than one percent by the end of the week. Elsewhere in Asia, Japanese stocks declined broadly and are significantly underwater YTD.

Other news and notes follow.

Millennials aren’t trying to be weird or different. Instead, they’re “less well off than members of earlier generations when they were young, with lower earnings, fewer assets, and less wealth,” according to a Federal Reserve discussion paper. “These balance sheet comparisons likely reflect, in part, the unfavorable labor and credit markets conditions that prevailed during the 2007–09 recession, some of which had prolonged effects.”

President Trump promised to cut regulations for businesses, and he has delivered. Deregulation is hard to quantify, but George Washington University’s Regulatory Studies Center keeps a great website loaded with data.

The closer any asset is to China, the worse it has performed all year. Industrial metals are down 16.6 percent, according to Bloomberg indexes. MSCI’s index of the developed-market stocks most exposed to China is down 8.9 percent. And inside China, a range of stocks tied to consumers have suffered the greatest losses: The CSI 300 index is down 18.9 percent for the year, but consumer discretionary, materials, information technology and telecoms stocks have all shed 26 percent or more.

As noted above, after days of vague Chinese statements and a barrage of comments from President Trump and other U.S. officials, China’s Commerce Ministry finally acknowledged last week that Beijing agreed to a 90-day cease-fire to allow further negotiations. Chinese government agencies and the nation’s supreme court also unveiled tough punishments for infringing on intellectual property, a prominent complaint from the Trump administration. Many are still on edge about whether the trade dispute between the two countries will curtail global economic growth. Meanwhile, hackers behind a massive breach at Marriott International left clues suggesting they were working for a Chinese government intelligence gathering operation, and Canadian authorities arrested the CFO of telecom giant Huawei Technologies at the request of the U.S. for alleged violations of Iran sanctions. The move is the latest in a campaign against the Chinese firm, which the U.S. views as a national-security threat.

U.S. tariffs aren’t stopping foreign-made steel. Since March, foreign companies have been subjected to 25 percent tariffs. Instead of isolating imported steel as the most expensive in the market, domestic steel producers have raised their prices by as much or more, moves that have generated higher profits while also driving up costs for other U.S. manufacturersand for U.S. consumers.

Now is the worst time to make money in the markets since 1972; there was a bull market somewhere in 2008 and 1974, when markets were awful, but not a single one of the eight main asset classes is up at least 5 percent so far in 2018.

Apollo’s Leon Black yesterday sounded the leverage alarm, speaking at a Goldman Sachs conference:

“The credit markets, unlike the equity markets, have gone to bubble status. The amount of covenant-less debt is more than 2007. You have a thirst for yield that exists on a global basis. So there is true excess.”

This assertion came just hours after Moody’s published (as reported by Axios) a report on the “alarming” number of private equity-backed companies with poor credit ratings, which “suggests an elevated default risk when credit conditions become more difficult and investors’ appetite for risk diminishes.” Moody’s says that around 90 percent of PE-backed debt issues are rated B2 or lower, compared to just 40 percent of spec-grade companies without PE sponsorship. But, right now at least, creditor recoveries are fairly similar for companies with and without private equity sponsors. This news came as debt multiples are on the rise for private equity companies. S&P LDC provided Axios with data showing that debt-to-EBITDA multiples for private equity deals are at their highest average levels since 2007. Bottom line: There’s not a lot of cushion there.

With a bipartisan array of five U.S. presidents seated in the front pews, former President George H.W. Bush was remembered for his lifelong commitment to public service, post-Cold War leadership and devotion to friends, families and a good joke at his funeral last week.Family members and politicians all joined in tribute to the former president.The president’s bodily was transported through Texas on the way to burial via funeral train, the first for a president in nearly 50 years.

Are retirement income fears overblown? Meanwhile, an important new survey

found that nearly 40 percent of retirees overspend.

The U.S. trade deficit hit its highest level in a decade.

The U.S. became a net exporter of oil and refined fuels last week for the first time in decades. The shift to net exporter may be short lived, and may have serious climate consequences. Still, it demonstrates that America is moving closer to achieving “energy independence” as the shale revolution makes it one of the world’s top oil producers.

Russia and OPEC have struck a deal to cut oil production by 1.2 million barrels a day that could make a dent in the oil supply glut.

Europe is in political turmoil. Germany’s Christian Democratic Union convened in Hamburg to select a new party leader for the first time since Angela Merkel claimed the post 18 years ago. Annegret Kramp-Karrenbauer, who was Merkel’s choice, was elected CDU leader in a tight race. Merkel intends to serve out her remaining term – until 2021 – but her election makes AKK the most likely successor. In London, Theresa May is feeling the sting of defeats inflicted in the parliamentary debate over a Brexit bill that looks all but certain to fail, and likely to doom her premiership. And in Paris, Emmanuel Macron has given in to a violent rebellion but not yet managed to end it.

U.S. employers slowed their pace of hiring in November, but wage growth matched the highest rate in nearly a decade and unemployment held at a very low level, showing the labor market remains a pillar of strength even as the stock market and other economic signals flash caution. U.S. nonfarm payrolls increased a seasonally adjusted 155,000 in November, the Labor Department reported on Friday. The unemployment rate held steady at 3.7 percent last month, again matching the lowest rate since December 1969. Year-over-year wage growth matched the prior month’s 3.1 percent pace as the best rate since 2009. The 155,000 November number is strong by any objective standard, but lower than the 198,000 consensus and the three-month average, at 170,000, was the lowest in a year. It’s also a noteworthy sign of economic deceleration. There have already been hints of that in rising claims for unemployment insurance, slumping housing activity, and in markets: stocks have been grinding lower and the yield curve is nearing an inversion, a popular leading indicator of recession.

[ctct form=”269″]