Good News Was Bad News

Despite the big game later today, last week was not very super for the markets. Good news became bad news as U.S. stock market indexes fell sharply Friday. Traders were forced to digest a stronger-than-expected jobs report that stoked inflation fears and contributed to a continued rise in bond yields. A couple of bruising sessions last week, including Friday’s declines, left their mark on the main indexes, with the S&P 500 and Dow seeing their worst weekly performance in more than a year and their first down week in 2018. Friday saw the biggest one-day decline of the S&P 500 in more than a year (over two percent) and last week saw the biggest weekly decline (almost four percent) in almost two years. All 11 sectors of the S&P lost ground. Politics — including the President’s State of the Union address and the Republican release of a House committee memo criticizing the FBI — had little market impact.

Press reports breathlessly described market action in stark and negative terms. But a bit of context is in order. Friday surely was not a good day and last week was not a good week. Given the lack of volatility generally over the past many months, things seems even worse. Yet Friday was only the 531st worst day ever for the Dow.

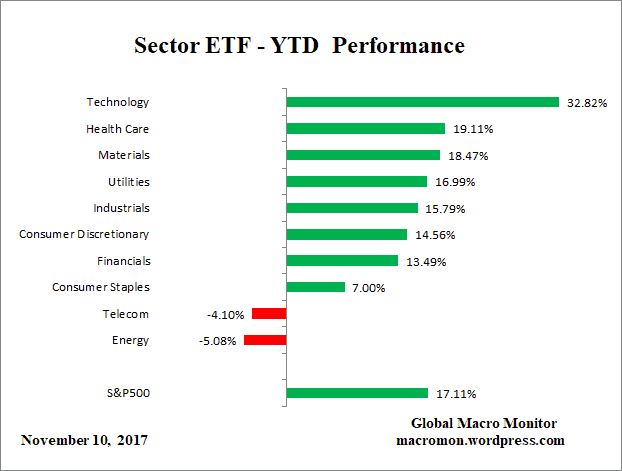

Energy stocks led the declines due to a drop on Friday following lower-than-expected earnings results from Chevron and ExxonMobil. Health care shares were also especially weak after tumbling Tuesday on news that Amazon, Berkshire Hathaway, and JPMorgan Chase were planning to cooperate in establishing a health care system for their U.S. employees. Financials fared better, helped by rising bond yields, which augur well for improved lending margins. Tech giants Apple, Alphabet (parent company of Google), and Amazon, which collectively represent over $2 trillion in market capitalization, reported mixed results, with investors punishing the first two for revenue and earnings misses, respectively, while rewarding Amazon for an earnings beat. Data and analytics firm FactSet raised its estimate for overall fourth-quarter earnings growth for the S&P 500 to 13.4 percent (on a year-over-year basis).

U.S. hiring was solid in January as the economy produced a better than expected 200,000 new jobs in January. The unemployment rate hovered at 4.1 percent for the fourth straight month, its lowest level in 17 years. Wage growth provided the best news as average hourly wages rose 0.3 percent, pushing the yearly increase to 2.9 percent, the fastest pace in more than eight years and a sign the tightening labor market may finally be producing notably larger pay raises. It was the 88th consecutive month of job creation, the longest streak of continuous hiring on record and a testament to the durability of the economic expansion that began in mid-2009, even as the pace of overall growth has lagged historical levels.

Global government bond yields, which dogged stocks all week, continued to climb on Friday. The yield on the benchmark 10-year U.S. Treasury note rose to a four-year high at 2.84 percent. Meanwhile, the yield on 10-year German government bunds added 4 basis points to reach 0.76 percent, close to levels not seen in more than two years. Higher returns on debt securities often tend to weaken appetite for stocks and other assets perceived as riskier.

The trend in inflation is ticking higher and a big longer-term question is whether the incoming Fed, which is more hawkish, will allow the economy to run hotter in the short term or tighten more aggressively. Either way, most analysts expect another rate hike at next month’s Fed meeting.

A broad-based retreat pushed European equities lower last week too as key regional indexes, including Germany’s DAX 30, France’s CAC 40, and the pan-European STOXX Europe 600, posted losses. The UK’s blue chip FTSE 100 Index lost almost 3 percent for the week, its worst performance since November. A rise in bond yields were the culprit there as well. Corporate earnings were generally solid, but for Deutsche Bank, and many traders seemed to believe that stock markets were repricing given a strong January performance.

Asian markets saw a mixed week, with the Nikkei 225 index down 0.9 percent on disappointing earnings. China’s official manufacturing gauge hit an eight-month low in January, a possible early warning sign of weakening growth momentum following unexpectedly strong growth in 2017.

Gold was a bit lower last week, while oil futures dropped 1.6 percent, and the ICE U.S. Dollar Index rose 0.6 percent to 89.21, although it is still down 3.1 percent YTD.

[ctct form=”269″]