Wall Street v. Main Street

There is a major disconnect in economic perspective between Main Street and Wall Street. Using May’s NFIB small business optimism index as a proxy for Main Street opinion, the economy is strong. May’s reading was the highest since October, hiring plans rose to the greatest level since December, and problems finding qualified applicants for job openings is hovering near record highs. Indeed, U.S. job openings today outnumber the unemployed by the widest gap ever. The NFIB concluded, “optimism among small business owners has surged to historical highs thanks to strong hiring, investment and sales…taking advantage of lower taxes and fewer regulations….”

On the other hand, pessimism is rising on Wall Street, largely related to tariffs. The recent “temper tantrum” six-week market decline really got going after President Trump tweeted his way into a trade war in early May. In response, Wall Street has been demanding interest-rate cuts to support the stock market. The president is fully on board with that, if unwilling to support free markets.

The Federal Reserve gets together again next week to revise its economic forecasts and we’ll see if the Fed decides to play ball. The latest data from the futures markets suggests that traders think there’s roughly a one-in-three chance that the Fed will ease next week. For the July FOMC meeting, the futures markets think there’s roughly a 90 percent chance the Fed will cut rates. They also think the Fed will ease again in September and a third time in December.

To give you an idea of how much things have changed, one month ago traders saw a roughly one-in-ten chance of two rate cuts by September. Now the odds are about three-in-four. The yield on the two-year U.S. Treasury note, which is often a good proxy for Fed policy, has dropped to its lowest yield in 18 months.

However, consistent with Main Street opinion, the substantive case for easing isn’t all that great. The recent jobs report was a little light, but the unemployment rate is still just 3.6 percent, close to a 50-year low. This week’s CPI report showed that consumer inflation is basically right in the Fed’s target zone. A 75 basis point rate cute implies the something is terribly wrong. It isn’t.

Wall Street expects, but the Fed may not deliver. However, there’s a big G20 meeting at the end of this month. I think it’s likely that the president will try very hard to announce some sort of breakthrough with China there, which would take the pressure off the market.

Domestic stocks were strong early last week due to last weekend’s reported deal between the U.S. and Mexico to avert tariffs before losing momentum later in the week. The S&P 500 and the Dow finished the week with modest gains. The small-cap Russell 2000 outperformed larger-cap indexes, but only slightly.

Last week’s weak inflation data helped push Treasury yields lower, with the yield on the benchmark 10-year U.S. Treasury note falling to 2.09 to end the week. Treasuries also benefited from the building geopolitical tensions in the Middle East and the continuing uncertainty about the trade war between the U.S. and China, which encouraged traders to move into safe-haven assets.

European stock markets ended last week higher, buoyed by the rise in oil prices, but still under pressure from U.S.-China trade tensions and weak Chinese industrial data. The pan-European STOXX Europe 600, the UK’s FTSE 100, the exporter-heavy German DAX, and Italy’s FTSE MIB all moved higher.

Chinese stocks rebounded last week as traders grew more confident that Beijing would step up stimulus measures to cushion the economy from the impact of U.S. tariffs. The benchmark Shanghai Composite ended up 1.9 percent, its best showing in eight weeks, and the large-cap CSI 300, which tracks blue-chips listed on the Shanghai and Shenzhen exchanges, added 2.5 percent. The latest gains came a week after both indexes closed at their lowest levels in almost four months. Japanese stocks were also up about 1 percent.

From the headlines…

U.S. inflation slowed in May, restrained by weakening price pressures almost across the board. The consumer-price index, which measures what Americans pay for household goods and services, rose just 1.8 percent from a year earlier despite a strong labor market and moderate wage gains. Of course, muted inflation could give the Fed cover to cut interest rates.

The U.S. budget deficit has increased to $738.6 billion in the first 8 months of the fiscal year — up $206 billion (almost 40 percent) from the same time last year. Of course, nobody in Washington, in either party, cares.

China says it is preparing to ride out a trade war. In fact, China has lowered its tariffs substantially, just on everybody but the U.S. The White House’s top economic adviser said President Trump could take further action against China if President Xi Jinping doesn’t agree to a meeting at the Group of 20 summit in Japan later this month.

Morgan Stanley (via Business Insider) has made its bear case for the trade war if the U.S. and China don’t end the tariffs:

· S&P 500 falls 16 percent to 2,400 over the next 6-12 months

· Earnings growth bottoms out in 2021 at -14 percent

· A full-blown economic recession hits in 2020

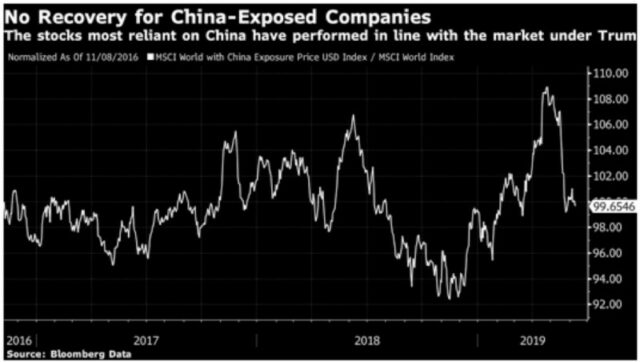

The negative attitude toward Chinese assets continues, too. Notice (below) how MSCI’s index of the 100 companies in its World index with the greatest exposure to China has compared to the MSCI World index itself since President Trump was elected. The biggest decline came with the first threats of tariffs last year. That was followed by a rebound after the Buenos Aires “truce” between Mr. Trump and China’s Xi Jinping last November, while the recent sharp fall dates from the presidential tweets promising extra tariffs on Chinese goods.

A slew of Chinese economic data came out last week. Chinese economic data on industrial output and investment published Friday added to evidence of a slowdown that some economists said risks breaching the government’s 6 percent bottom line for growth (which would still be the slowest in a quarter-century), unless there is more stimulus. The factory output number, the weakest since 1992, follows disappointing trade data published last week showing exports nearly flat and imports falling 8.5 percent in May. Loan expansion in the period lagged every other month this year.

Oil prices surged Thursday after two tankers were damaged in a suspected attack in the Gulf of Oman, near the Strait of Hormuz.

Trade volumes are flat or down across major economies the world over, possibly auguring recession.

At last weekend’s Group of 20 meeting, officials criticized trade tensions for slowing economic growth worldwide. Bowing to pressure from the U.S., however, their public joint statement didn’t mention “tariffs.”

In Born to Win, Schooled to Lose, researchers found that being born “affluent” but dim carries a 7 in 10 chance of reaching a high socioeconomic status as an adult, while being born intelligent but “disadvantaged” means just a 3-in-10 shot. Talent is universal, but opportunity is not.

There are a lot of touchy subjects to bring up when you want to preserve wealth over generations.

Social Security faces a big test next year. It will have to start drawing down assets to pay out promised benefits for the first time since 1982.

The good, bad, and ugly of SEC’s Reg BI. States are likely to be the next battleground over the fiduciary debate. A fiduciary rule is proposed for Massachusetts.