Round Trip

The market round trip back to new highs after the Q4 swoon is complete. Some think that means clear sailing ahead. The basic argument is here:

“A lot has changed since autumn. A once-aggressive Federal Reserve says it’s on pause, Treasury yields have fallen half a percentage point, valuations are sturdier, and trade talks between the U.S. and China have progressed. Investors are limping back, more chastened than euphoric. Memories of the bull market’s near-death experience have kept inflows to stocks far below the explosive levels of last year.”

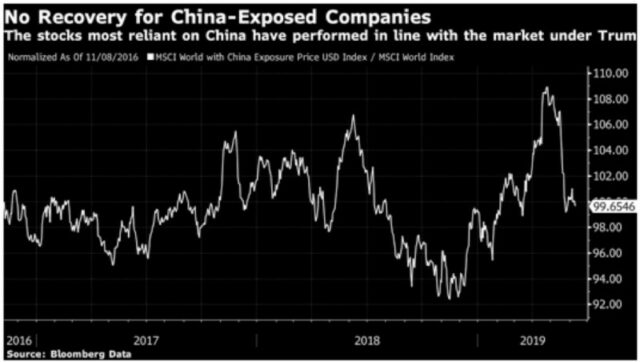

In other words, and to quote The Clash, this has been a pause that refreshes. But is it? Although the S&P 500 sits at a never before reached level, there are only 13 stocks within the S&P 500 at new highs. John Authers, at least, is skeptical of the market’s strength:

“This looks to me like a needed correction which has been undone unhealthily quickly, in large part because the Fed is perceived to have panicked and because investors are highly geared to each new piece of information that comes out of China. My greatest reason for concern comes from the economy. We are presumably later in the cycle now than we were in 2015. The economy is stronger now, but what really matters to markets is the direction of travel, and on this score the completion of this round-trip looks to have been premature.”

He isn’t alone: “Bridgewater Associates recently warned clients that the immense widening of margins over the last 20 years, which it says accounted for half of the developed world’s stock returns, could be at a turning point. Strategists at Goldman Sachs have warned about profitability coming under pressure, too. At Morgan Stanley, researchers are pointing to decelerating global survey data as a precursor to lower margins.”

Moreover, the dirty little secret of this year’s rally is that it has been fueled more by share buybacks than by real-money investors buying. Therefore, don’t be so sure the stock market will only go up from here. The arguments of bears are summarized here. Still, some say there’s no reason to think the market can’t keep going up indefinitely.

Whatever happens going forward, here’s what happened in the markets last week.

Domestic stocks posted modest gains last week, with the tech-heavy Nasdaq and smaller-cap benchmarks outperforming large-cap indexes. The S&P 500 hit record highs on Tuesday and, after losing some of its upward momentum, again on Friday. The S&P has now climbed roughly 25 percent from its recent low on Christmas Eve. Trading volumes continued to be lackluster despite many major companies reporting quarterly earnings numbers. Technology bellwether Microsoft posted strong quarterly earnings, pushing its market capitalization briefly above $1 trillion and boosting the Nasdaq, while industrial conglomerate 3M’s shares plunged after it posted disappointing sales figures, weighing on the Dow.

Crude oil prices were volatile last week. Oil jumped on Monday and Tuesday after the Trump administration confirmed that it will end waivers allowing certain countries to continue to buy Iranian crude. However, oil fell on Thursday and Friday after data showed that U.S. crude oil inventories reached the highest levels since October 2017, erasing the commodity’s early-week gains and pushing prices lower for the week. Energy sector stocks suffered along with crude, and disappointing earnings from some major energy companies compounded the sector’s woes.

On Friday, the Commerce Department said that U.S. GDP grew at a 3.2 percent annual pace in the first quarter, surprising many observers who had expected slower growth in a quarter that featured a government shutdown and severe winter weather. However, the report showed that consumer spending increased at a disappointing 1.2 percent rate, slowing significantly from the fourth quarter of 2018. The positive and negative aspects of the GDP data seemed to offset each other, resulting in little effect on stocks.

The yield on the benchmark 10-year U.S. Treasury note fell to 2.51 percent last week.

In Europe, the STOXX Europe 600 moved slightly higher last week as first-quarter earnings season got into full swing there too. In Asia, while Japanese stocks traded slightly higher last week, mainland Chinese stocks posted their biggest weekly decline since last October amid fears that Beijing would dial back policy support after China’s economy grew more than expected in the first quarter. For the week, the Shanghai Composite and the large-cap CSI 300, China’s blue chip benchmark, each lost more than 5 percent.

From the headlines…

Fortune magazine’s sixth annual list of the World’s Greatest Leaders is the home of the brave — thinkers, speakers, and doers make bold choices and take big risks. Explore the list.

Upwards of 40 world leaders joined Chinese President Xi Jinping in Beijing for the second international gathering on his Belt and Road Initiative, a plan to build a massive network of ports, roads and railways across some 65 countries. Belt and Road is just one element of China’s plan to supplant the U.S. as the dominant global superpower.

The IMF lowered its global growth forecast; the third cut in six months and its lowest forecast since the financial crisis.

A new report by the European Central Bank finds the U.S. economy could be hit much harder than either China’s or the eurozone’s in a fresh escalation of international trade tensions.

Nobel laureate Joseph Stiglitz makes the case for progressive capitalism. Lots of billionaires are worried too: “In places such as Silicon Valley, the slopes of Davos, Switzerland, and the halls of Harvard Business School, there is a sense that the kind of capitalism that once made America an economic envy is responsible for the growing inequality and anger that is tearing the country apart.”

Pimco makes a case for emerging markets. Bridgewater makes a case for global equities. GMO’s Jeremy Grantham argues that investors should be jumping at the chance to allocate to climate-change strategies.

Federal Reserve officials are starting to talk about the conditions under which they would cut interest rates.

A strong dollar makes U.S. exports less competitive and eats away at profits for U.S.-based multinational firms. Currency traders generally buy the dollar when they are worried about global growth and when U.S. economic data is strong. After weak manufacturing readings in Germany and Japan, strong U.S. retail sales, and 50-year-low initial jobless claims data, both of those themes seem to apply. That provides a good explanation for why, on earnings calls so far in the first quarter, FX and currency worries – dollar strength – have been the most cited negative by S&P 500 companies.

Finance marketing pros give their opinions about recent ads from Wells Fargo, Schwab, Fisher and others.

The U.S. is ending waivers for countries to import Iranian oil, part of the Trump administration’s effort to drive Iran’s exports to zero, the White House announced Monday. The goal is to block all Iranian oil exports. Secretary of State Mike Pompeo claimed the U.S. “maximum pressure” campaign has already begun to reduce Iran’s power, though that’s far from clear.

Senior citizens lose about 25 times more to scammers than official statistics indicate, a new study found, with total losses as high as $27.4 billion a year.

The 2019 annual report of the Social Security trust fund is out. According to the latest data, Social Security’s costs are projected to begin exceeding its income in 2020 and the program’s reserves will be depleted in 2035. That is a slight improvement over a year ago. The Medicare program’s finances also look about the same as they did a year ago. Medicare’s Part A trust fund will become depleted in 2026.

U.S. workers who are using financial advisors are saving more for retirement than their peers, but they still aren’t saving enough. Millennials (who believe – really – that they will be rich and have faced more financial hardships than previous generations) with advisors have saved an average of $89,724, or 28 percent more than those without advisors, the survey said. Baby boomers have saved more than $333,085, compared with $286,671 for those without an advisor.

You’re a widow. Now what?

President Trump announced in a Monday tweet that Herman Cain was withdrawing his name from consideration as a member of the Federal Reserve’s Board of Governors, just a week after Cain said he wouldn’t withdraw.

We worry too much about super-rare events such as selfie deaths and market crashes.

The U.S. economy grew at a 3.2 percent annualized rate in the first quarter of the year — a faster pace than the previous quarter’s 2.2 percent and significantly more than the 2.1 percent economists were expecting, the Commerce Department announced on Friday, thanks to strong exports and consumer spending. Sales of previously owned U.S. homes sputtered in March despite lower mortgage rates and a strong job market, marking 13 straight months of annual declines. However, the pace of new-home sales in March rose to the highest level in more than a year. Orders for long-lasting factory goods rose in March at the fastest clip in seven months.

With the U.S. economy generally strong and stocks at record levels, retirees’ and workers’ confidence in having enough money for retirement has risen over the past year to all-time highs, according to the 2019 iteration of a long-running survey released Tuesday. A new Fidelity survey explored why Americans are uncertain about their financial futures. Here is a case against early retirement.

How rich are you by world standards? If you live in the United States, the answer is almost surely “pretty rich.”

New Jersey’s newly proposed uniform fiduciary plan “far exceeds” the SEC’s Regulation Best Interest as well as the Labor Department’s now defunct fiduciary standard rule.

Facebook’s reputation is tanking, but it’s still ahead of the federal government. How do other big companies stack up?

Warren Buffett sat down for an interview with The Financial Times, in which he reflected on his investment record and the challenges he faces.

Since the beginning of 2015, Americans’ total financial assets have grown by nearly $11 trillion, Federal Reserve data shows, but less than one percent of that gain has been from hedge fund investments. Aside from a select few managers who continue to generate inflows and decent returns, hedge funds as a whole have been losing investors — an average $5.4 billion of outflows per year since 2015, data from research firm eVestment shows – and underperforming generally.

The share of teens aged 16–19 who work summer jobs has fallen significantly. Just 35 percent had a summer job in 2017, compared to more than half of teens who had one in 2000 and 58 percent in 1978.

A study by EY recommends that financial firms adopt a subscription model or risk being outrun by tech firms entering the market.

The number of endowments and foundations that believe the economy has worsened, and see a slowdown as their biggest long-term threat, has tripled over the past year.

Opportunity Zone funds haven’t even got off the ground yet and they are already enduring calls for further scrutiny.

Church attendance continues to plummet in the United States.

[ctct form=”269″ show_title=”null”]